What is the Electricity Cost Per Unit?

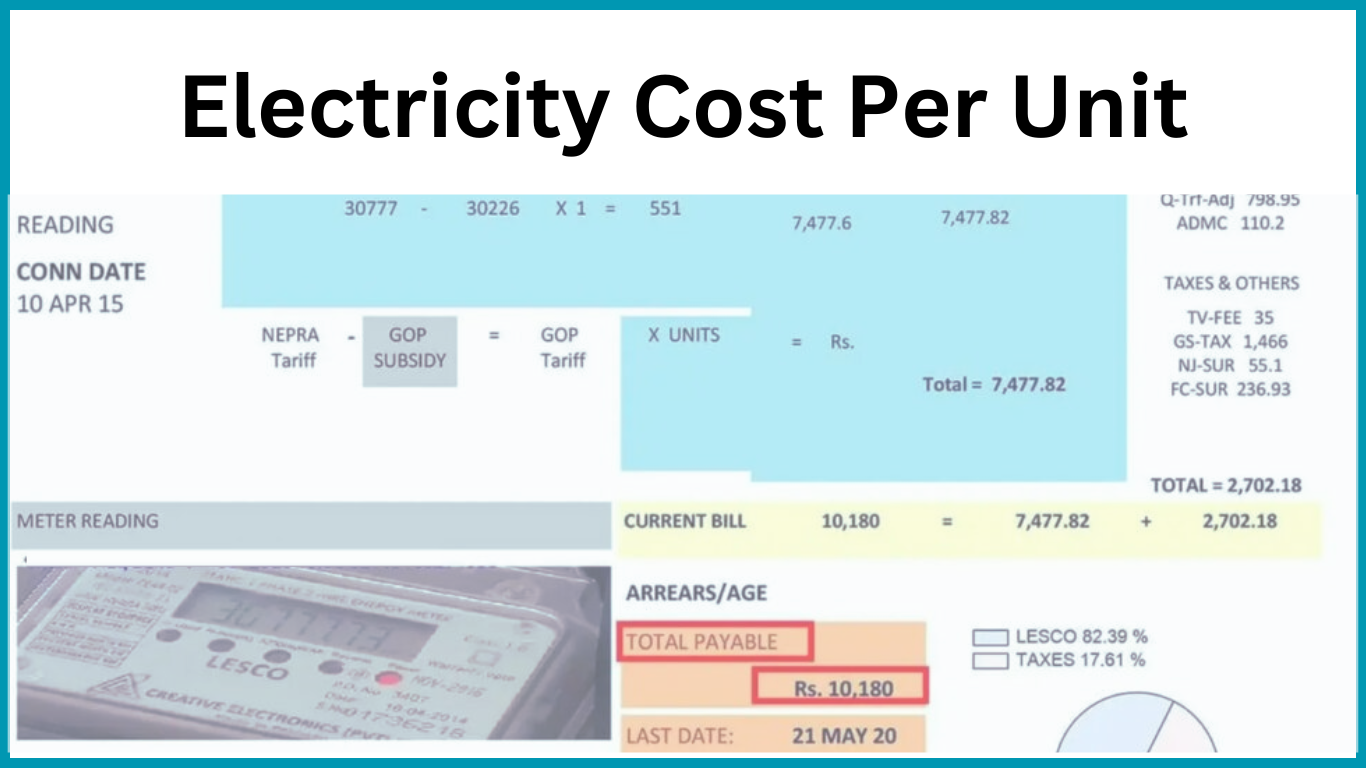

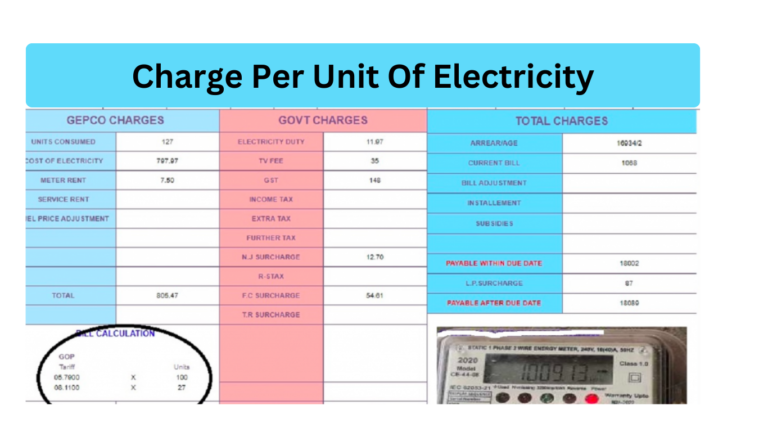

Calculate the Electricity Cost Per Unit is the most important factors to consider when purchasing products or services. Now a days Cost of 1 unit of Electricity is PKR 35.50 Understanding the price of a single unit is crucial for efficient budgeting and comparison.

This is regardless of whether you’re purchasing a single item or numerous units. The cost of one unit, its relevance in many circumstances, and how it might affect your decision-making process will all be covered in this article.

Per Unit Price.

The complete costs involved in producing or acquiring a single unit of a good or service are called the cost of one unit. It accounts for a number of cost factors, including labour, raw materials, manufacturing overheads, and other related costs. Businesses may evaluate the sustainability of their pricing plans, compare prices across various suppliers, and analyse profitability by figuring out the cost of one unit.

The Value of Estimating One Unit’s Cost

For a number of reasons, figuring out the price of one unit is essential. First of all, it enables companies to provide reasonable pricing to clients that also covers costs. Additionally, it makes it possible to compare prices among suppliers, supporting well-informed choices regarding where to buy supplies or outsource production. Analysing the cost of one unit also helps assess profitability, pinpoint cost-cutting opportunities, and improve operational effectiveness.

Factors Affecting the Electricity Cost Per Unit

Electricity Cost Per Unit is affected by many things. For efficient cost management and decision-making, it is crucial to comprehend these elements. Here are some important factors to consider:

Costs of raw materials

The cost of one unit is substantially influenced by raw materials costs and supplies. Changes in currency exchange rates, supply chain interruptions, and fluctuations in commodity pricing can all impact the overall costs associated with purchasing the required inputs.

Production and labor costs

Wages, benefits, and training expenses all contribute significantly to unit price. Labor costs are also influenced by the manufacturing process effectiveness and the degree of automation used. These expenses can be reduced by streamlining manufacturing processes and maximizing staff utilization.

Overhead expenses

Various expenses that aren’t directly related to the manufacture of a single unit but are important for a company’s overall operation are included in overhead costs. Rent, utilities, insurance, executive compensation, and marketing costs are examples. It is essential that one calculates the cost of one unit by dividing these expenses across the units generated.

Benefits of scale

Manufacturing in greater quantities provides economies of scale. Fixed expenses are distributed over more units as manufacturing volume rises, lowering unit cost. Businesses can attain economies of scale by streamlining manufacturing procedures, obtaining better prices from suppliers, or purchasing sophisticated equipment.

Calculating the Cost of 1 Unit Accurately calculating the cost of 1 unit requires accounting for both external and indirect costs. Direct costs, also known as overhead costs, are expenses allocated to each unit produced. They can be directly related to the production of a single unit, such as raw materials and direct labour.

One Unit Cost

For organization, understanding unit costs has many useful applications. Let’s examine a few crucial places where it is very pertinent:

Pricing techniques

Businesses may choose a pricing plan that covers costs and keeps them competitive by understanding unit price. It helps define a successful selling price by evaluating aspects such as market demand, competition, and target consumers’ willingness to pay.

Cost evaluation

Businesses may make educated judgements by analysing the price of 1 unit when comparing various suppliers or sourcing options. It enables a side-by-side comparison of pricing, quality, and dependability, helping identify the most affordable and dependable solutions.

Profit evaluation

Analyzing the Electricity Cost Per Unit in relation to the selling price allows businesses to assess their profitability. By comparing the revenue generated per unit with the associated costs, companies can evaluate their profit margins and make strategic decisions to improve profitability.

Impact of the Electricity Cost Per Unit in Different Industries

The significance of 1 unit cost varies across industries. Here’s a look at its impact on different sectors:

Manufacturing

In the manufacturing industry, where physical products are produced, the cost of 1 unit directly affects profitability. Manufacturers strive to minimize production costs while maintaining quality standards to stay competitive in the market.

Retail

For retail businesses, understanding the cost of 1 unit is crucial for inventory management and pricing decisions. It aids in setting the selling price, locating suppliers who are efficient in costs, and evaluating profit margins for specific products.

Service-based enterprises

Service-based companies may not have tangible components in the conventional sense, such as consulting firms or software suppliers. To ensure profitability and competitiveness, they must still figure out the cost of providing their services.

Electricity Cost Per Unit in a Manufacturing Company

In order to demonstrate how the cost of 1 unit is actually used, let’s examine the case study of a manufacturing firm that makes electrical products. The cellphone manufacturer wants to examine the cost of a single unit of one of its well-known models.

Problems with Calculating One Unit’s Price

Businesses may encounter difficulties when determining the price of a single product. These are some typical challenges they could run into:

Variable expenses

Some costs, like raw materials or labour, might change over time. It might be difficult to calculate the exact cost of 1 unit since expenses fluctuate. To account for these variations, cost estimations must be regularly monitored and adjusted.

Variable market prices

The cost of a single unit becomes harder to calculate for enterprises operating in markets with rapid price fluctuations. Price fluctuation may impact input costs, necessitating routine cost computation updates.

Challenges in Determining the Electricity Cost Per Unit

Variable Costs

Electricity costs can vary due to changes in fuel prices and demand. These fluctuations make it challenging to maintain a consistent cost per unit.

Fluctuating Market Prices

Market prices for energy can fluctuate based on geopolitical events, supply and demand, and other factors. These fluctuations impact the cost of electricity and require ongoing adjustments in cost management.

Cost Heterogeneity

Different types of electricity generation (e.g., renewable vs. non-renewable) and varying regional regulations can create differences in electricity costs, making it challenging to compare costs across different contexts.

Strategies to Reduce the Electricity Cost Per Unit

Process Optimization

Improving energy efficiency through process optimization can reduce the overall cost of electricity. This includes upgrading equipment, optimizing energy use, and reducing waste.

Supply Chain Management

Effective supply chain management can help lower raw material costs and improve energy procurement strategies, contributing to reduced electricity costs.

Technology Implementation

Investing in energy-efficient technologies and renewable energy sources can lower the electricity cost per unit. Technologies such as smart grids and energy storage systems enhance efficiency and reduce costs.

Conclusion

Effective cost management, pricing strategies, and decision-making in a variety of businesses depend on unit costs understanding. Businesses can correctly determine the cost of one unit by considering both direct and indirect costs. Companies may set competitive prices, evaluate expenses, assess profitability, and make wise business decisions using this knowledge.

For More Information Visit Our Website: https://onlinebillmepco.pk/